Card Saver

Effortless Payment

Solutions for Thriving

Businesses

At Card Saver, we believe that smooth, efficient transactions lead to happier customers and thriving businesses. Our mission is to provide small businesses with versatile, user-friendly card terminals that make payment processing a breeze. Whether you’re operating online, in-store, or on-the-go, we’ve got you covered with a range of solutions tailored to fit your unique needs from our strategic partners.

Seamless Transactions

Our multi-use card terminals are designed with simplicity and reliability in mind. We support thousands of merchants across the UK with seamless payment solutions, ensuring quick, secure, and hassle-free transactions.

Why Card Saver?

Quick

Onboarding

Get up and running in no time with our straight forward setup process.

Minimum

Documents

We keep things simple with minimal paperwork.

UK-Centered

Customer Help

Our friendly support team is always here to help you.

4.5 Stars on

Trustpilot

Join the ranks of our satisfied customers who rave about our service.

Our devices accept all major payment methods

From credit and debit cards to digital wallets, we ensure you never miss out on a sale.

Fast, Reliable Funding with

just a few clicks.

A Cash Advance from our trusted partners offer a simple funding solution for businesses processing card payments, providing up to 200% of your average monthly takings with a fixed fee and no APR. Repayments are flexible, adjusting to your cash flow through your card machine. With no business plans needed, this UK Government-approved option provides instant offers and funding in as little as 24 hours.

Any questions? Our expert UK-based support team is here to help. Whether you need assistance with setup or have a query about your payment solutions, our online chat is always open. Just reach out, and we’ll ensure you're 100% up and running.

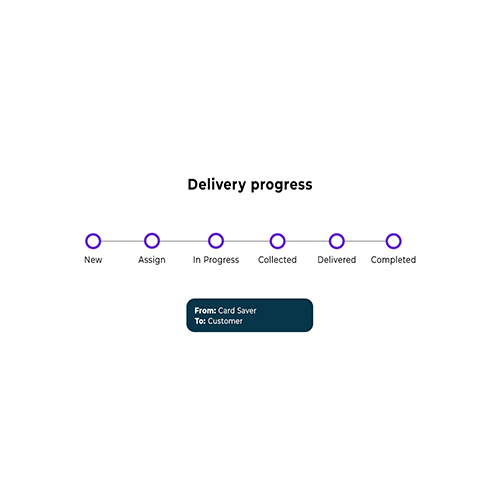

We know your business can't wait. That’s why we offer free delivery of your Card Saver Card Machine, ensuring you can start accepting secure transactions within just three days of approval. You’ll be ready to go in no time, thanks to our logistics experts who have helped thousands of businesses across the UK.

Gain access to extra funding with a business cash advance

- Rapid Access to Funds

- Flexible Repayment

- Transparent Costs

- No Restrictions

- Easy Application

Explore our products

Customer Reviews

Nikki Dibs

- VERIFIED CUSTOMER

We’ve been with Card Saver for over 2 years now. They are always been friendly, responsive and efficient. This week, for the first time ever, we had a little issue with our card terminal connectivity. Paul was straight on the case! He sorted it quickly and perfectly! Thanks Paul and all at Card Saver. Highly recommend!

Mario Errigo

- VERIFIED CUSTOMER

I have just renewed my card processing contract with Sean Clancy of Card Saver, Looking forward, my monthly fees have been reduced by nearly 20%!

The whole process was made much less arduous thanks to Sean’s assistance. Thank you.

Michael Cooke

- VERIFIED CUSTOMER

No more cash-only fares—accept card payments securely and quickly with our mobile payment solutions, making every ride smooth for you and your customers.

Kevin

- VERIFIED CUSTOMER

I found that Paul Was very knowledgable and Willing to help all the way through from the start of ordering the new card machines right through to helping me set them up. With a freindly attitude. Very Helpful.

John Brewer

- VERIFIED CUSTOMER

Paul was very helpful and talked me through the new card machine very patient with a nearly 70 year old lady!!!