Starting your own business does not have to be as complicated as it sounds. With our 10 steps guide, we will take you through each stage of the business start-up process. From researching your market to creating your brand, hiring staff and finally, advertising it to your potential customers.

Step 1: Develop a solid idea

Before you start to build your dream, it’s vital to have a vision, know which market the idea will fit in and complete field research to provide you with a better understanding of that market. It is important to pick apart your concept to ensure it is sustainable. All new ideas must solve a problem, meet a need, or fill a gap in the market, and if your idea meets these criteria you are one step closer to starting your business.

Step 2: Put together a business plan

Once you are confident with your idea, the next step is to create the master manual for your entire company, investigate and tackle any finances you are going to incur, map out your logistics and determine what your likely success rate for the first few years is going to be. Research and analyse your competition to help you to refine your idea.

Within this step you also need to come up with a name for your idea – this is important as it is the first point of contact you have with your customer. It needs to create an initial appeal and be pleasant to see, hear and say. Keeping your business name short and snappy helps with recognition and memorability.

Step 3: Choose a business structure and register your business

There are several business structures and it is essential you choose the one most appropriate to you – the list at the end of this article will help you. The best route depends on the nature of your business and your individual circumstances. Register your business here.

Step 4: Seek and sort funding

By now you should have a concrete business idea and be registered as a business. You are now able to start applying for funding, and there are many ways to do this such as through loans or grants, appealing for crowdfunding, or entering competitions.

At Card Saver, we offer a Business Cash Advance, which is a simple funding solution and an easy alternative to traditional bank loans. You could receive a cash advance of between £2,500 and £300,000, which can cater for all your business needs. Business Cash Advances can help you invest in your business simply and seamlessly. More importantly, you only pay us back when your customers pay you, so it works perfectly in line with your cash flow. You can find out more and apply here.

Step 5: Create your brand

Branding is the core of your business, therefore, it is vital that it is noticeable and memorable. When designing your logo, it should clearly portray what your business does, the personality you want your business to have and what your target audience is. This is also a time when you should be creating any tag lines you want to use and your promise of quality to your customers.

Step 6: Any additional legal requirements

Through your research, you should already know if there are any further legal requirements for your business such as licenses, permits or specific kinds of insurance you need to comply with laws and regulations. If in doubt, consult someone with experience in your business area or a professional.

Step 7: Get systems in place

Within any business, there are various systems you will need to put in place, and while you may be an expert in your company, it is not likely you will be as confident in processes and systems. You can either outsource or learn the specifics yourself, but make sure you cover the essentials first such as payroll, accounting and IT.

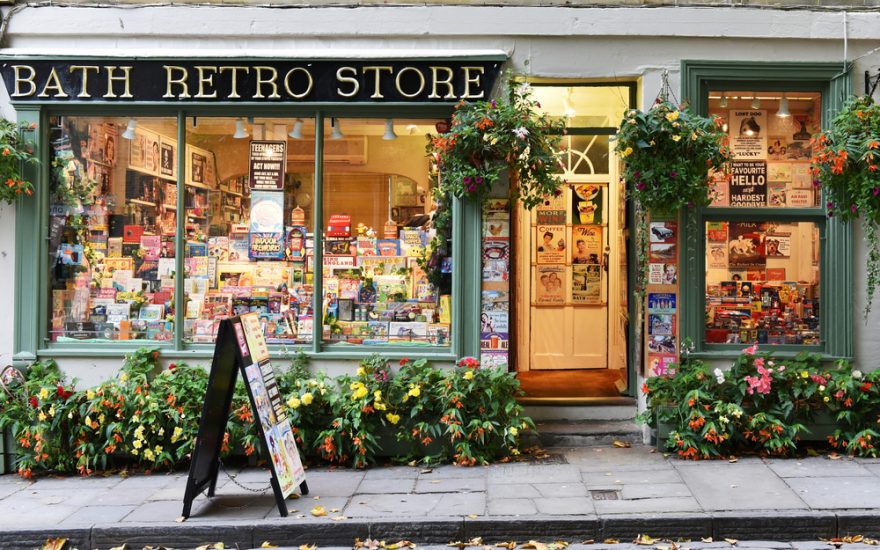

Step 8: Prepare your work area

Whether you are working from home or opening a hairdressing salon, a professional workspace is critical and it needs to be somewhere that is comfortable but also promotes productivity. Make sure you have all the necessary supplies and equipment you will need for the day to day running of your business.

Choosing a card machine is essential when starting your business and choosing one that is right for the structure of your business as well as the pace is important. Card Saver provides contactless card terminals that take fast and secure payments, whether you plan to take payments in your place of work or on the go. Find out more and get a quote here.

Step 9: Hire and train staff

Employees are at the heart of every business, so it is crucial that you make sure your employees are on board with your ideas and vision, and that they understand where they fit in. You should be looking to hire people who bring knowledge, skill, enthusiasm and something new to your idea. It is important to treat them right, provide them with the correct training for their role and show appreciation for the work they will be doing for you. Communication between members of staff is key to helping your dream to become successful.

Step 10: Promotion

The most important part of any business is its customers, you will not go far if there aren’t any. That is why you should make sure you develop and maintain a vigilant advertising and marketing strategy that will be consistent throughout your business, in order to attract customers.

Business structures

Sole trader – this is the structure you should choose if you are going to be self-employed or if you are going to run a business on your own.

General partnership – this involves two or more individuals or companies. The responsibility of the business and profits are shared equally, each partner pays tax on their share and they are both liable for the debts and losses. This is most suitable for small businesses in the UK.

Limited liability partnership (LLP) – there is a partnership agreement where each partner is not personally responsible for debts that the UK business can’t pay. This partnership requires a written LLP agreement and needs to be registered at Companies House.

Private limited partnership (Ltd) – a separate legal entity to those who run it. There is at least one director and at least one shareholder and they are incorporated through registration at Companies House. Shares within the company can only be traded privately.

Public limited company (PLC) – these are companies in which shares can be traded publicly. There needs to be a minimum share capital of £50,000 with at least 25% paid prior to start-up.

Social enterprise – these invest any profit made into charitable, social or community objectives and do not distribute it among shareholders.